- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Allow me to explain. Ad Get a Card with 0 APR Until 2022.

Credit Cards Vs Debit Cards The Truth In 10 Simple Steps Infographic Credit Card Infographic Credit Vs Debit Credit Card

Credit Cards Vs Debit Cards The Truth In 10 Simple Steps Infographic Credit Card Infographic Credit Vs Debit Credit Card

Credit cards will have higher interest rates and there will be fewer 0 Balance Transfer Credit Cards if any.

The truth about credit cards. Most store cards do not care about your credit rating and simply have set interest rates. It made no sense that consumers could not pay down their most expensive debt without first paying down all the other debt on their credit card. Almost every business has its own credit card or financing option.

The Truth About Credit Cards July 1 2011 by Justin I was reading an article recently that was talking about how great credit cards are and how you cant live life without them. The Ugly Truth About Credit Cards - YouTube. This leaves about 150 points for credit card utilization.

If you generally pay off your entire credit card balance each month but often have a tough time doing so you may want to think about timing your credit card purchases. Listen along to hear the dangers of buying things on credit how credit scores work and one possible benefit of putting your purchases on a credit card. If you make easy affordable minimum credit card payments it will take you 381 months 32 years to pay off your balance assuming you NEVER use your credit cards again during that time.

Many of these cards are owned and serviced by large national financial institutions. Our Experts Found the Best Credit Card Offers for You. The Truth About Credit Cards How to fix your credit quickly How to Increase Your Credit Score Effectively.

Installment loans likely count for way less of this category -- about 30 points out of the 180 total points is likely for installment loans. Of the Amounts Owed the most important portion is amounts owed on credit cards. Lets break it down.

Credit cards have billing cycles typically 30 days or roughly one calendar month. Plenty of people love credit cards for the sole purpose of using the rewards or coupons they get. Heart - Up On Cherry Blossom Road.

And sure you might get free shipping twice a year or a 15 off coupon the first Tuesday every other monthbut is it really saving you money. All purchases made during a given billing. And those debit card purchases wouldnt still be haunting you today.

They are not inherently good or bad. It went on to explain how you need credit cards to rent a motel room purchase goods or services online pay for emergencies etc. The Truth About Credit Card Debt and How to Responsibly Build Credit If credit cards had their own relationship status on Facebook pages wed probably click Its Complicated Its no secret that everyday Americans enjoy the freedom of swiping at the supermarket and the convenience of online shopping.

Credit cards are a tool. In my business and personal life we try to put as much of our expenses on a credit card to get the most from our 2-3 cash back rewards as possible. Today Paul and Arlene talk about credit cards and why they can ruin your financial goals if youre not careful.

Credit card companies will be prohibited from raising your interest rates due to late payments or defaults on other credit cards. You would have paid off the entire 9100 in credit card debt plus 10113 in interest for a total of 19213. Or that chasing you through a collections agency or.

Put simply things need to make sense for the credit card issuer to approve your application and extend the appropriate credit limit. This is especially true of store credit cards. IMPACT ON YOUR WALLET.

If playback doesnt begin shortly try restarting. MY VOTE. Credit cards can be a great way to build credit get rewards and earn cash back.

Our Experts Found the Best Credit Card Offers for You. Overspending isnt the only hazard of credit card usage. Ad Get a Card with 0 APR Until 2022.

Even if you do make a lot of money if you have a ton of outstanding liabilities they will raise your debt-to-income ratio which is your monthly liabilities vs. But in some cases credit card issuers realize that getting everything you owe simply isnt realistic. Similarly Javelin Strategy and Research took a look at Cyber Monday spending habits and found that the average credit card purchase was 8210 whereas the average debit card purchase was only 5829.

The Truth About Lifetime Free Credit Cards Techsling Weblog

The Truth About Lifetime Free Credit Cards Techsling Weblog

Pay Off Your Credit Card With These Five Steps The Job Window

The Truth About Credit Cards Credit Cards Debt Debt Relief Programs Rewards Credit Cards

The Truth About Credit Cards Credit Cards Debt Debt Relief Programs Rewards Credit Cards

Now Is The Time For You To Know The Truth About Visa Credit Limit Visa Credit Limit Https Ift Tt 31fhe9o Visa Credit Visa Credit Card Credit Card

Now Is The Time For You To Know The Truth About Visa Credit Limit Visa Credit Limit Https Ift Tt 31fhe9o Visa Credit Visa Credit Card Credit Card

The Ugly Truth About Credit Cards Isg Planning

The Truth About Credit Card Debt In The Us National Debt Relief

The Truth About Credit Card Debt In The Us National Debt Relief

The Truth About Credit Cards And The Advantages On Offer The Katy News

The Truth About Credit Cards And The Advantages On Offer The Katy News

What Is The Truth About Credit Cards

What Is The Truth About Credit Cards

The Truth About Credit Cards For Bad Credit Bad Credit Credit Cards Bad Credit Paying Off Credit Cards

The Truth About Credit Cards For Bad Credit Bad Credit Credit Cards Bad Credit Paying Off Credit Cards

The Zero Moment Of Truth For Credit Cards

The Zero Moment Of Truth For Credit Cards

The Truth About Credit Scoring Buckets Coast Tradelines The Most Trusted Authorized User Au Tradeline Company Since 2010

The Truth About Credit Scoring Buckets Coast Tradelines The Most Trusted Authorized User Au Tradeline Company Since 2010

6 Credit Card Myths And Facts You Need To Know The Truth About

6 Credit Card Myths And Facts You Need To Know The Truth About

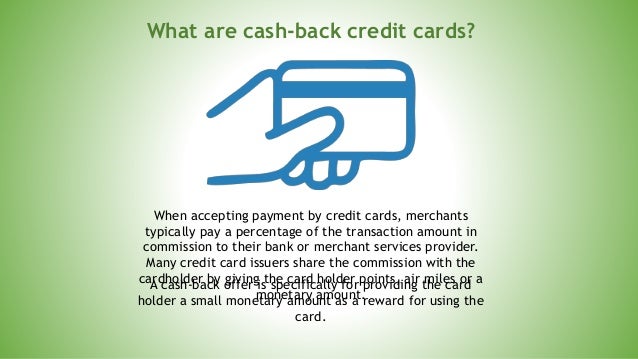

The Truth About Cashback Credit Card

The Truth About Cashback Credit Card

The Truth About Cashback Credit Card

The Truth About Cashback Credit Card

Comments

Post a Comment